The first ICO was run in 2013. Even though it has only been five years since their invention, now ICOs are widely used by startups to raise initial capital. On the other hand, more and more investors inspired by the success of previous ICOs are eager to try their luck and place their money into one of the new projects. 2017 became the year of ICO boom with more than $4 billion collected for dozens of startups, and the trend continues.

What is ICO? ICO, or initial coin offering, is a capital-raising method that somewhat resembles crowdfunding but with certain potential profit for investors, too. Investors contribute funds to the startup by participating in the so-called token sale when they transfer their money. Usually Bitcoin or Ether, and get the ICO cryptocurrency, or tokens, in exchange. You can read more about ICOs and how they work here.

For the investors, the most common way of making a profit from ICO investment is trading the tokens at the exchange. When the project gets successful and starts making a profit, the tokens associated with it may rise in value. Of course, you need some analytical abilities, an expert’s advice or just a piece of luck to sell your tokens at the right moment.

Just like any other investment, ICO investments involve certain risk which may have nothing to do with the scam. It may happen that you have invested in a totally legit project that simply did not succeed. Unfortunately, such things happen, and it is not much you can do here.

However, there are ICOs that are launched with the only purpose of taking off with your money. Although it may be hard to definitely detect an ICO scam, there are some things that may indicate that the ICO is not what it pretends to be.

How does ICO scam work?

For the startups, the main attraction of ICO funding is its minimal regulation. As compared to other forms of financing, such as VC investments or IPOs, launching an ICO is a breeze – the company only needs the idea and the ICO platform. That’s it, they can start the countdown timer.

For many young companies ICOs remain the only channel of gathering funds to kick off their projects. But there are those wishing to use the general ICO hype for their dirty purposes. Here, the deregulated nature of ICOs sometimes plays into their hands. Because there is no way to verify their genuineness.

The scammers launch an initial coin offering that, on the surface, is exactly the same as dozens around it. There are all the necessary components – a convincing white paper, a good website, a team of experts. Investors start pouring in their crypto coins – and then the “project” simply dissolves. This is the so-called “exit scam,” the most common method of an ICO fraud.

How to detect an ICO scam?

If you are planning to invest in ICO, you should choose carefully. There are too many ICOs nowadays, even if you limit your options to a particular sector. For example, if you choose cryptocurrency exchanges, you will still be left with several ICOs that look the same at first glance.

To reduce your chances of running into an ICO scam, you should do some homework. And, sometimes, consult experts on the matters that you cannot fully understand. That is the minimum you can do to protect your investment.

Most ICOs have the same basic structure:

- A white paper explaining the startup idea, the problem and its solution as well as the investment procedure.

- Project roadmap scheduling the most important milestones.

- Project team introduction presenting the bios of both the project developers and the advisers.

- Investor terms and conditions laying down the rules of ICO participation.

- The social section containing links to the project’s pages in social networks, forums, article references, etc.

Each of the components may contain some signs of the ICO scam, and we are going to explain what you should watch for.

#1 – The startup idea is not disruptive or innovational

Read the white paper and try to see whether the startup is really going to create something worth supporting. It may be either a totally new concept or an improvement of an existing one that is going to bring dramatic optimization.

The best-case scenario is that the project is going to fail if the startup is planning to develop something that already exists. Moreover, if there is more than enough competition on the market for this product. In the worst-case scenario, there is no project at all.

#2 – The white paper is not clear

The white paper of a proper project should clearly describe the problem the startup is trying to solve and the proposed solution. True, in some cases, the white paper may be too technical for a person with no special knowledge. In this case, turn to an expert and ask them to check whether the white paper makes sense.

The white paper may be full of such words as “innovational”, “cutting-edge”, “technological breakthrough”. If, in fact, it describes no real product or solution, there is a high chance that the project is going to be an ICO scam. Of course, if you notice that the white paper or other ICO website content is not original and contains a high share of plagiarism, better stay away from it.

#3 – The blockchain use is not justified

The nature of ICOs demands that the projects for which ICOs are run use blockchain. For each ICO, a special blockchain smart contract is built to process the investments and issue tokens to investors.

However, not all products or applications require blockchain or own cryptocurrency. Sometimes, the project can operate effectively using the common currencies, such as Bitcoin or Ether. In other cases, the decentralized structure that blockchain offers is not relevant for the proposed solution.

Again, this is a question for an expert. A blockchain professional can help you determine whether the project described in the ICO actually needs the blockchain technology or not. If the blockchain is developed just for the purposes of token sale, the probability of an ICO scam is very high.

#4 – The team’s identities and experiences are not authentic

Check the startup team very carefully. Find their profiles on LinkedIn, and Google any references to their names. In a legit project, the professional experience of each team member mentioned on the ICO website matches their careers found on other resources.

Obviously, if you cannot find any references to the people listed as the project team, or if their photos are different from those posted on the ICO website. Or if such people exist but are working in totally different industries, this should ring very loud alarm bells.

At the same time, if the team members are suddenly replaced, especially very close to the ICO start, this is also a bad sign. If the experts are pulling out of the project, they must have a good reason for that.

#5 – The roadmap is not realistic

Usually, you can find the project roadmap on the ICO website. If the roadmap is clear and shows achievable milestones, the project may be considered authentic. If, on the other hand, there is no roadmap or the roadmap looks impossible to keep to, you may think that it was added to the website just to make it look “right”.

By the time of the ICO start, the roadmap should already show certain progress in terms of research and development. And, in some cases, the availability of a finished product or prototype. If the project already has a product, it is an indicator of a valid ICO.

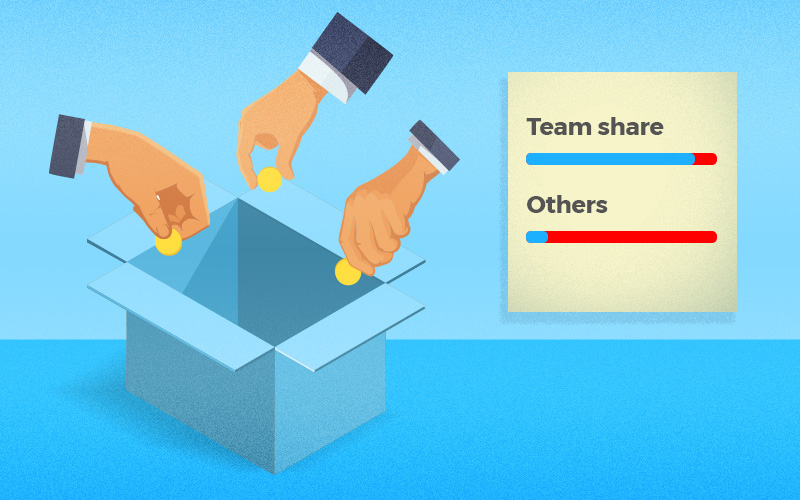

#6 – The token distribution favors the team

The project white paper should include the detailed explanation of the token distribution after the ICO. The first thing you should pay attention to is whether there is a pre-sale and how many tokens are allocated to it. A pre-sale, as such, does not necessarily mean that there is something wrong with the ICO. It is a method of attracting and rewarding early adopters and investors.

However, an unreasonably high share of tokens allocated to the pre-sale should be an alert for you. Similarly, if the token distribution in the crowd sale proper shows a disproportionately high share for the team, this may be a sign of an ICO scam. Usually, the ICO team, the advisors, and the board are allocated about 50% of the total number of tokens.

In this context, also look up the total amount the ICO aims at, the so-called soft and hard cap. You can estimate whether the amount corresponds to the purpose of the project. A simple application should not require hundreds of millions of dollars.

#7 – The community is weak

An ICO usually runs several channels of communicating with its potential investors. For example, a Facebook page, a Telegram channel where users ask various questions related to the ICO and the project behind it, a blog space describing the project and its progress.

A weak, inactive community can show either the lack of interest towards the project which should discourage you from investing. Or the reason is in a team’s intention not to go on with the project but just to collect the money. Try asking a question in a support channel and see, on the one hand, how promptly the team responds, and, on the other hand, how professional their response is.

Of course, “professional” scammers may also imitate a thriving community and 24/7 support, but there can be other indicators of fraud.

#8 – The user registration is not required

This is not a direct indicator of the ICO scam, because there may be perfectly valid ICOs with no or minimum user registration. However, together with other alerts, the absence of user registration or verification should warn you against an ICO.

Usually, user registration is intended to ensure compliance with various KYC and AML regulations. For instance, the ICO team has taken the trouble to work out the verification procedure compliant with the legislation of multiple jurisdictions. If they implemented a mechanism of user registration, that may mean that they are serious about their project.

To invest or not to invest – that is the question

If you have read this far and have totally lost all faith in investing in cryptocurrency, let us try to convince you otherwise. Investments in ICOs and cryptocurrency trading are a perfectly valid method of investment. And, with a healthy degree of due diligence, you will choose a good faith project and hope to profit from it.

However, as with any investment, use only as much money as you are safely prepared to lose. Do not invest your kids’ college money or empty your savings accounts for an ICO. At the same time, be open to new opportunities that the blockchain technology offers.

With our checklist, you can take a better-informed decision about investing in a particular ICO. If you see that the analysis of a certain coin offering raises too many red flags, better forget about it. As the saying goes, better safe than sorry.

Another hint for choosing authentic ICOs is to look for them on the reputed resources. Check, for example, the ICO calendar on Cointelegraph or ICO Alert. A listing on such resources adds to the credibility of the startup.

If you are interested in following the latest news on the blockchain, cryptocurrencies and ICO, subscribe to our blog. If you browse the blog posts, you will also find our “ICO FAQ” series where we explain the basic concepts related to this sector, such as cryptocurrencies, ICO and blockchain explained simply and the related best practices.

Also, visit us on our website where you can get the idea of the technologies we work with and the projects we have delivered. Particularly, if you are interested in blockchain and other related matters, check our blockchain app development service experience. Contact us with any questions or proposals, we’ll be happy to cooperate with you.