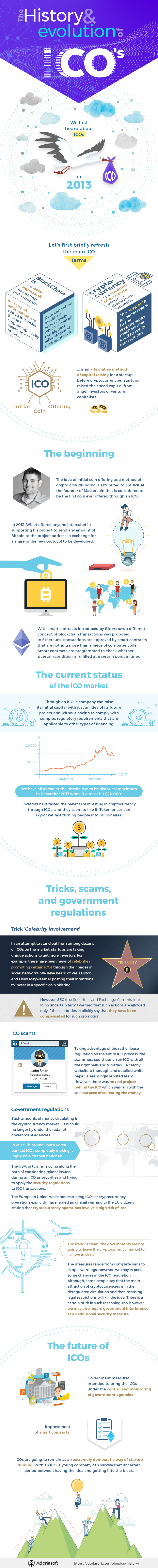

We first heard about ICOs in 2013. Now we are in 2018, which means that ICOs have been around for about five years only, and that does not look like too much. However, when it concerns cutting-edge technologies, time accelerates, and the five years that elapsed since the first ICO have been tightly packed with events and inventions. We have seen the birth of the second-largest cryptocurrency, the creation of a universal platform for most ICOs, the flash ICOs and the ICOs that never closed, the millions of dollars raised within minutes.

Still, let’s start from the beginning, as the ICO history is fascinating enough to deserve detailed analysis. The role of ICOs in the current economy is large enough to make both their supporters and those who do not believe in them want to know about their past and, most important, about their future.

However, before we begin, we will briefly refresh the main ICO terms and their meanings, so that we can move along easier.

What is blockchain? Blockchain is the technology of storing data in the form of blocks that are cryptographically linked to each other. Within blockchain, data cannot be modified retroactively which is one of the biggest advantages of such approach. All transactions in a blockchain are approved by consensus of the users which increases the trust and transparency.

What is cryptocurrency? Cryptocurrency is a medium of exchange based on the blockchain technology. Each transaction or creation of a new unit is verified by a cryptography algorithm, hence the name. The first cryptocurrency was Bitcoin invented in 2009 together with the entire concept of blockchain.

How does cryptocurrency work? Basically, it works like our regular bank payments when the sender’s account balance decreases and the recipient’s account balance raises. However, with crypto money, it is not the bank that verifies the transaction but a special algorithm.

What is ICO? ICO, or initial coin offering, is a blockchain-based fundraising methodology which is effectively a crowdsale of tokens, or new cryptocurrency. The funds gathered via the ICO are used to finance the project for which it was launched. If the project is successful, the tokens grow in value bringing profit to the investors.

Now, let’s proceed to the history of initial coin offerings and their current status. The infographic below demonstrates how ICO appeared and evolved. Please scroll down for more details.

The beginning

The idea of initial coin offering as a method of crypto crowdfunding is attributed to J.R. Willet, the founder of Mastercoin that is considered to be the first coin ever offered through an ICO. Willet’s idea was building another layer on top of the Bitcoin protocol to create another coin with different rules adding value to the Bitcoin technology and providing new features.

In 2013, Willet offered anyone interested in supporting his project to send any amount of Bitcoin to the project address in exchange for a share in the new protocol to be developed. The shares were offered in the form of new coins, Mastercoin, that were later renamed to Omni. He explained the details of his project and the team hiring process and promised a reward to the early adopters. The Mastercoin ICO managed to gather about $500,000 that was used to fund the project.

That was the first ICO that was tentatively followed by several others. The ICO evolution took a leap in 2015 when the Ethereum platform was launched. Ethereum ran its own ICO in July 2014 closing in August at $14 million. During the ICO, the startup offered a new cryptocurrency, Ether. The funds collected through the Ethereum token sale allowed creating a new distributed computing platform supporting smart contracts development.

With smart contracts introduced by Ethereum, a different concept of blockchain transactions was proposed. In Ethereum, transactions are approved by smart contracts that are nothing more than a piece of computer code. Smart contracts are programmed to check whether a certain condition is fulfilled at a certain point in time. If so, the transaction is processed, otherwise, it is rejected.

This is the underlying principle of all ICOs that are based on the Ethereum platform. The technology supported by Ethereum have turned out so effective that now more than 50% of all ICOs are running on Ethereum using its smart contracts. And Ether has grown to be the second most valuable and circulated crypto coin after Bitcoin.

The current status of the ICO market

Since the appearance of Ethereum and the introduction of its technology, the ICO market snowballed to the size that became noticeable on the global economy scale. On the one hand, both startups and established companies have appreciated the advantages of such fundraising methodology when you can collect millions of dollars within hours or even minutes. For example, we took part in the development of an Initial Coin Offering that closed in seventeen minutes with the hard cap of more than $5 million.

In short, through an ICO, a company can raise its initial capital with just an idea of its future project and without having to comply with complex regulatory requirements that are applicable to other types of financing.

On the other hand, investors have tasted the benefits of investing in cryptocurrency through ICOs, and they seem to like it. Token prices can skyrocket fast turning people into millionaires. We have all aahed at the Bitcoin rise to its historical maximum in December 2017 when it almost hit $20,000. Such trends bring more people to ICOs turning them into a “Gold Rush” of the 21st century.

The ICO market got into full swing in 2017. The recent ICO statistics show that in 2017, the number and the total amount of raised capital grew steadily, December being the absolute winner with 45 successful ICOs gathering more than $1 billion in total. The grand total for 2017 amounted to almost $3.9 billion.

The first three months of 2018, in their turn, already exceeded the 2017 total approaching $5 billion with almost $2 billion in March only. Obviously, the ICO market is gaining momentum sucking in more and more money. Moreover, ICOs are beginning to fuse with the traditional financing methods – for example, Indiegogo launched an own crowdsale platform as an additional crowdfunding channel.

Tricks, scams, and government regulations

Most often, startups enter the ICO market with a white paper describing the project and laying down the estimated timeline of its fulfillment. The would-be investors choose the project they wish to support by analyzing their white papers and judging whether the idea is viable or not. With dozens of ICOs going on every day and the same number of scheduled ICOs, making the right decision may be tough for the prospective investor.

At the same time, the startups feel the pressure of competition getting stronger with each passing day. The best way of attracting investors is making a clear and comprehensive white paper that contains exactly enough information to communicate the project value to the reader. Still, the investor may easily become overwhelmed with the number of ICOs, some of which seem to be working in the same area.

Celebrity involvement

Naturally, intense competition calls for non-traditional methods of attracting attention. In an attempt to stand out from among dozens of ICOs on the market, startups are taking unique actions to get more investors. For example, there have been news of celebrities promoting certain ICOs through their pages in social networks. We have heard of Paris Hilton and Floyd Mayweather posting their intentions to invest in a specific coin offering.

However, SEC (the Securities and Exchange Commission) in no uncertain terms warned that such actions are allowed only if the celebrities explicitly say that they have been compensated for such promotion.

ICO scams

While these are just tricks intended to attract the public attention, some ICOs are downright scams. Taking advantage of the rather loose regulation on the entire ICO process, the scammers could launch an ICO with all the right bells and whistles – a catchy website, a thorough and detailed white paper, a seemingly reputed team. However, there was no real project behind the ICO which was run with the sole purpose of collecting the money.

The Benebit Initial Coin Offering is considered to be the largest ICO scam. The “startup” presented a completely valid idea of creating a blockchain-based customer loyalty system that was described in a professionally made white paper. The ICO started in a usual manner and was progressing well until somebody noticed that the team photos were, in fact, photos from a school website. When the scam was blown, the Benebit team took the money they managed to collect – the reported figure is $2.7 million, while other sources claim that it was as high as $4 million – and disappeared.

Government regulations

Of course, with such amounts of money circulating in the cryptocurrency market, ICOs could no longer fly under the radar of government agencies. More and more countries are making attempts to bring blockchain coins and the related activities under their rule. In 2017, China and South Korea banned ICOs completely making it impossible for their nationals to participate in coin offerings.

The USA, in turn, is moving along the path of considering tokens issued during an ICO as securities and trying to apply the security regulations to ICO transactions. Their reasoning is that, although ICO investors do not get actual shares in the company, they get assets that grow in value with the project performance. These attempts of bringing ICOs under the monitoring of SEC have resulted in the warning for US citizens against participation in ICOs.

The European Union, while not restricting ICOs or cryptocurrency operations explicitly, have issued an official warning to the EU citizens stating that cryptocurrency operations involve a high risk of loss.

Although different jurisdictions take different measures, the trend is clear – the governments are not going to leave the cryptocurrency market to its own devices. As we see, the measures range from complete bans to simple warnings, however, we may expect some changes in the ICO regulation. Although, some people say that the main attraction of cryptocurrencies is in their deregulated circulation and that imposing legal restrictions will kill the idea. There is certain truth in such reasoning, too, however, we may also regard government interference as an additional security measure.

The future of ICOs

With the ICO market growing exponentially, many experts, startup owners, and individual investors are gazing into their crystal balls trying to see what the future has in store for them. We have seen that the industry of coin offerings has sprung from zero to billions of dollars in only five years, thus, the future may be closer than you think.

What seems to be definite enough is that there are going to be government measures intended to bring the ICOs under the control and monitoring of government agencies. At the same time, this trend should not be regarded only as a restrictive measure limiting the possibilities of both startups and investors. On the contrary, adequate regulation may protect investors from ICO scams.

Another solution to the same problem may be the improvement of smart contracts. They may get more sophisticated to provide better protection for investors – for example, by offering the investors the possibility to vote on the startup progress. If the consensus finds the project unsuccessful, the smart contract may refund the investments.

At the same time, initial coin offerings are going to remain as an extremely democratic way of startup funding. With an ICO, a young company can survive that uncertain period between having the idea and getting into the black. There may be changes, but for the moment, ICOs are a great funding method for a young company.

That was our brief account of the ICO and coin history with a little glimpse of the future developments. Check out other articles in our blog where we have the specific aspects of ICO explained in detail and discuss the ICO meaning for startups. Subscribe to our blog to get the latest news of the blockchain market and cryptocurrency investments.

If you are thinking of running an ICO of your own, we can help. Bring us your idea, even if that is the only thing you have. We can support you every step of the way – from drawing a professional white paper to blockchain and smart contract creation. The success of an ICO largely depends on the quality of the blockchain app development, thus, it is something that is better be entrusted to the experts. Browse our website to see the blockchain services we provide and contact us for more information.